In the business world,

video surveillance has often been considered a necessary cost of doing business. Initial investment in any new system comes out of a company’s capital expenditure, and “returns” can be difficult to calculate mainly if it simply works to deter crime, or for cost avoidance. With the advent of

4K, which offers four times higher the resolution and pixels on target than HD, users can expect to increase the value of their system’s investment more easily. More pixels on target, combined with content analytics, offers the potential for the genuine calculation of ROI.

Loss prevention and cost reduction benefits

Traditional

loss prevention applications, such as point of sale and cash till monitoring, remain strong applications for high resolution systems such as

4K, with camera count reduction being an obvious win in terms of cost of acquisition and system maintenance. For one major UK retailer, clever deployment of high resolution cameras, video management software and analytics nearly halved its shrinkage from 0.8 percent to just 0.4 percent within the first two years — which translated into hundreds of thousands of pounds of savings. In doing so, the number of employees caught in the act increased five-fold.

Beyond traditional loss prevention efforts,

4K resolution-based installations can unlock cost reductions in direct security operations, supporting ROI. For example, one US Fortune 500 company was able to deliver a 33 percent reduction in its video systems’ running costs. It calculated cost of use in terms of man-hours required to retrieve and review event footage. With a higher resolution video system, not only were they able to reduce the man-hours required for this activity, but they also cut the cost per hour of running the system.

Business intelligence

Finally, by bringing together

4K, analytics, cloud storage and “

big data”, it becomes possible to deliver concrete and accelerated ROI in a more consistent manner.

4K video data, combined with these technologies, will enable data from various sources to form a powerful source of business intelligence.

A

4K video system can be used to monitor shop aisles for loss prevention, and the same video data can be mined to help understand consumer behavior via “heat mapping” analysis of traffic patterns, people counting, etc. The resulting intelligence can then be used to develop tools to increase sales such as targeted sales promotions, queue management, improved store layouts, etc.

Building the case for 4K systems Justifying an investment in

4K video becomes easier when you include traditional

loss prevention, operational cost reductions and efficiencies, and now potential top-line revenue increases from better merchandising and store management.

To make the strongest business case for

4K systems, managers may still want to funnel investment toward the areas where they see the highest risk of losses. To this end, securing areas where there is significant risk to human life or high value assets are two clear areas where we anticipate early adoption of

4K: power plants, chemical plants, airports, stadiums, casinos and banks, for example. In addition, managers across any large organization can share the system to realize benefits in multiple departments and build an ROI story much quicker as a result.

Addressing limitation issues

Much has already been written about the factors affecting the adoption of

4K as a standard in the security industry. These typically include the cost of infrastructure and hardware. However, technological and market advances are addressing these limitations with the introduction of

H.265 compression and the rapidly declining price of

4K monitors. With these advances,

4K is on course to become the next big

video surveillance standard within two to five years.

High performance lenses for high performance systems

But not much has been written on the importance of finding compatible high performance lenses for use in these emerging

4K systems. Without a compatible one, the lens will become the limiting factor in the system, throttling the overall image resolution performance and effectively wasting the investment by delivering sub-

4K images. There are only a few commonly used

4K sensors in the security market today. These sensors are not much larger than those used for HD or higher megapixel resolution cameras, but their pixel count is significantly higher and the pixel sizes they generate are necessarily much smaller.

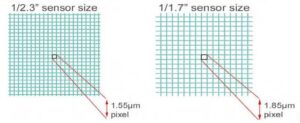

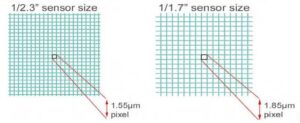

For example, while a typical 5-megapixel sensor is 1/ 2.5” in size with 2.3 micron-sized pixels, the IMX172

4K sensor from Sony is 1/ 2.3” in size, with 1.55 micron-sized pixels — that’s 33 percent smaller than the pixels of the 5-megapixel sensor. Meanwhile, the Sony IMX226 sensor is larger at 1/1.7” in size with 1.85 micron-sized pixels—19 percent larger than the pixels of the IMX172 sensor, but still 20 percent smaller than the typical 5-megapixel sensor pixel size. (Refer to image 1)

The pixel size also dictates the level of contrast in line pairs per millimeter that the lens is required to resolve. For example, the smaller 1.55 micron-sized pixel requires the lens be able to distinguish 300 line pairs per millimeter (lp/mm), while the 1.85 micron-sized pixel requires the lens distinguish 270 lp/mm.

The above shows the pixel sizes found on two different

4K sensors, a smaller sensor (left) compared to a

larger sensor (right).

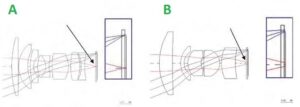

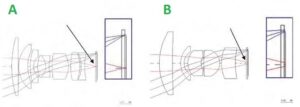

Finding a lens with the power to resolve the smaller size pixels and deliver adequate contrast is a challenge. The focal plane spot size of the lens must be comparable or smaller than the pixel size on the sensor (Figures A and B); otherwise, the rays of light trained through the lens will fall off the pixel and the image will be muddy, instead of crisp.

The availability of lenses which can resolve these small

4K pixels is limited right now. They typically require a more complex lens design. The design requires a greater number of more complicated elements such as plastic molded aspheres. They need better glass, plastics and coating materials. Adding IR correction for day/night performance in

4K resolution presents further design, manufacture and cost challenges to work through.

Camera companies have, in some cases, paired fixed focal length machine vision lenses with their newly-minted

4K cameras. Varifocal lenses, which give the installer more control over the fine-tuning field of view and fewer lens types to order, are even more difficult to find right now with acceptable

4K performance, especially in sizes compact enough to fit in reasonably-sized

dome cameras.

The figures above show how

4K lenses focus light to a small spot (A), whereas bigger pixels of larger sensors

don’t require such a small focus spot (B).

Smaller vs larger image sensors

As one can imagine, the smaller sized

4K pixels cannot physically collect as much light as those of the larger pixel size sensors. This reduces image quality in low light conditions, and would lead one to believe that the industry would be more inclined to adopt the larger 1/1.7” pixel-sized sensor.

However, a larger sensor requires larger lenses, making both sensor and lens more expensive. So from this, we can predict that the smaller 1/2.3”

4K image sensors will be selected for

4K economy-line cameras; while the larger 1/1.7” sensors may be reserved for top-end, “high performance”

4K cameras. The

4K cameras and lenses are still only made in low volumes, making them more expensive.

These higher performance, higher resolution lenses support smaller pixels. They also increase the complexity and cost of lenses. However, without these new lenses,

4K is in danger of over-promising and under-delivering.

Implementation of 4K systems The selection of

4K-rated hardware and systems, when used in key applications, can make an easily supported business case. Alignment in purpose during the selection of systems — both hardware and software — for key applications can make the difference in justifying the implementation of

4K video systems today.

Source: a&s Magazine