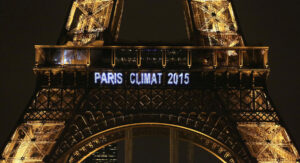

The recent climate-change deal reached in Paris has drawn much attention to the rising importance of renewable energy sector. Among the several proactive measures taken at the summit, a key decision was the promise of greater investment in renewable technology.

According to media reports, all the major development banks, including World Bank, and the African and Asian Development banks have backed this deal and pledged to boost lending for low-carbon projects over the next 20 years.

Large-scale investments can now be expected in solar, wind and other renewable technologies and research and less into fossil fuel development and possibly mining. In fact several low-carbon plans were already announced at the summit. A key project among them was an Africa-wide mega-scale plan to develop at least 10 GW of new renewable energy generation capacity by 2020 and at least 300 GW by 2030.

For security solution providers in the energy sector, this opens up a world of new opportunities. In fact, the recent dip in oil prices had caused several oil companies to limit their expenses, and this has dampened sentiments for security solution providers in this vertical. But what it has also done is prompt these solution providers to consider alternative energy markets.

Some of the major security companies are already in this segment. Now that the climate-change agreement has ensured extensive investment, entry of more solution providers can be expected. Given the expensive nature of its infrastructure, this segment could be a catalyst for growth of the security industry in the coming years.

The security requirements at a standard solar field are as follows:

Solar farms are usually very large, open areas that are difficult to patrol, making them well suited for smart thermal cameras, which can detect intrusions over large areas effectively and with 27/7 vigilance.

Both micro and macrosystems need more security as their installation rates increase,” Hamilton said. “Microsystems that are installed on top of building are susceptible to thieves looking for copper. Not only is copper theft an issue, but the potential of fatal accidents are a major liability for these installations. Macrosystems, or massive solar farms operated by large energy providers. These sites have the same type of threats, but must be protected by a comprehensive system that starts at the design stage. Copper theft is a key issue, one that costs the U.S. tens of millions of dollars every year.

These sites are often in remote locations and have no physical perimeter protection. Remote viewing capabilities, virtual tripwires and similar surveillance solution functionality are what appeals to this particular market.

According to the International Energy Agency (IEA), increased accessibility to photovoltaics and stronger commitment to limiting climate change could push global investment in renewable energy to US$7.4 trillion by 2040.

With countries trying to depend less on fossil fuels, and the current low oil prices, protecting these investments will be a priority. What’s more encouraging is its development in emerging markets like Asia and Africa, which are expected to be the drivers of security market in the coming years. Combined with the investment and the demand from developing markets, this segment is one to watch for in the coming years.

Source: a&s Magazine