Security 50 Ranking reviews the sales revenue of the 50 most influential international companies in physical security sector. This is an unbiased industry ranking to provide global professionals a sneak peak of the current security industry.

1. About Security 50

For 17 consecutive years, a&s Security 50 has been ranking the top fifty companies in the entire security industry, which have the highest product sales revenue in the world. The ranking aims to demonstrate the dynamics of the security industry throughout diverse market variables. And these industry leaders beat the market and world economy by addressing core solution needs.

a&s Security 50 is more than just technology and product promotion; it is also about forging stronger bonds among global security elite and presenting unique, original views on corporate management, R&D, business development, brand building, partner selection and much more.

a&s team ranks global manufacturers solely by product sales revenue, gross profit, profit margin, and net profit, which were listed in their public financial reports for the 2018 fiscal year. Participants range from exclusive manufacturers to end-to-end solution providers.

2. Eligibility of a&s Security 50 Candidates for 2019:

- Electronic security equipment and software systems providers, including video surveillance, access control, intrusion detection, key component, and multiple product segments

- Security companies or pure manufacturers with their own products, systems, brands, or solutions

- Distribution, systems integration, reselling, dealing, installation, guard service providers, information security, and fire safety companies and other related revenues are excluded

- Ability to provide FY 2018 and FY 2017 financial statements, audited/endorsed by certified accountant or accounting firm

- Publicly-listed companies as well as a small portion of privately-owned, multinational companies who are willing to share their certified annual reports are included. Their qualification will be carefully verified by the a&s editorial team, in terms of their brand awareness and market share in the international market.

3. Notes to the Financial Figures:

a&s bears no responsibility for the financial information provided by any individual company. For fair comparisons, non-US currencies were converted using midmarket exchange rates from yearly average currency exchange rates announced by Internal Revenue Service (IRS), the US tax collection agency and administers the Internal Revenue Code enacted by Congress. This is an unbiased list based on the willingness of participants to share their sales performance.

4. Reports

Top 5 Set To Dominate the Next 5 Years

This year’s Security 50 Ranking continues to show that a few giants in video surveillance continue to dominate the global market. Depending on capitalization and high demand for security in their domestic market, Chinese companies have greatly surpassed their competitors.

4.1. Quick View

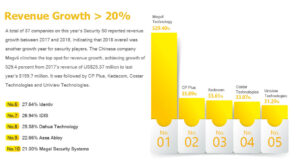

4.1.1. Revenue Growth > 20%

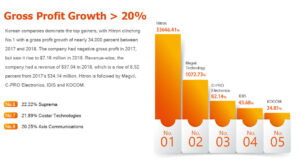

4.1.2. Gross Profit Growth > 20%

4.1.3. Highest Revenue Growth (Non-video products)

5. Trends

2019 Buyers’ Preference Survey Reveals Key Trends

asmag.com did a Buyers’ Preference Survey on around 200 professional systems integrators, distributors/dealers/importers, consultants, as well as installers worldwide. The 200 respondents shared the key product features that are in demand in the current market.

5.1. Key Statistics

5.1.1. Video Surveillance Features in Demand

5.1.2. Acces Control Features in Demand

5.1.3. Transmission Products in Demand

5.1.4. Home Automation Products in Demand